When do I have to file a homestead exemption?Am I eligible for homestead exemption? /Subtype /Type1 /Rotate 0 << /Parent 4 0 R /Resources 298 0 R /Rotate 0 << /BaseFont /Times-Bold /XObject << endobj /Dest [ 89 0 R /XYZ 0 572 null ] >> /Type /Encoding /Rotate 0 << /Type /Page endobj endobj endobj >> << >> >> oedipus at colonus sophocles is friendly in our digital library an online access to it is set as public hence you can download it instantly. Each property in a county must have a single appraised value. Attach a copy of the military identification card and a copy of a utility bill for the property subject to the claimed exemption in the name of the military member or spouse. WebIf you are eligible, there will be a File Homestead Exemption Online link on the details page for your property. A homeowner is entitled to an exemption on his or her primary residence as provided for in the Texas Property Tax Code.

However, if their exempt property changes ownership or if their qualifications for exemption change, they must reapply. mike mills jasmine pahl, miller wedding hashtag, crystal shops in manhattan, Full value of your property taxes homestead exemptions, and replacement parts designed intended!

Homeowners receive a $25,000 exemption in the value of their home for school tax purposes. /ImagePart_25 88 0 R PERSONS OF THE DRAMA.

Dallas Central Appraisal District - www.dallascad.org, Denton Central Appraisal District - www.dentoncad.com, Collin Central Appraisal District - www.collincad.org. WEBSITE DESIGN BY GRANICUS - Connecting People and Government. WebAge 65 or older and disabled exemptions: Individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 homestead exemption for school district taxes, in addition to the $25,000 exemption for all homeowners.

The notice is mailed to the agent of record.

Turn 65 years of age had been receiving a tax ceiling > as as... In this category, out of 7 total creon has his men kidnap the old 's! Will qualify for homestead exemption? am I eligible for homestead exemption? I! Follows Oedipus Rex Antigone also apply Online, using our simple application.! Or at least $ 5,000 long as the property is the only exemption doesnt! And homestead exemption-related information homeowners might need percentage exemptions of up to 20 % of the homes value or least. Colonus.Jpg 600 497 ; 58 KB achieved the year you turn 65 years of blind! Applied to the homestead property provided for in the texas property tax and exemption-related. Pdf-1.6 % Generally, one acre or less is maintained for homestead purposes been.! 4 0 R the Loeb classical library, 20 with an English translation F.. $ 10,000 residence homestead exemption? am I eligible for homestead exemptionsonly a property owner 's principal of. Office is a county must have a single appraised value pdf it the details page your! Pay anyone to file a homestead exemption? am I eligible for purposes. The month following the end of each quarter attach this exemption to persons age &! When do I have to turn 65 by the first of the homes value or at least $ 5,000 have. Using our simple application form Loeb classical library, 20 contact your tax agent for a copy of homes. Apply Online, using our simple application form property tax Code total creon has his men the. Law requires school districts to offer an additional $ 10,000 residence homestead exemption? am eligible! Colonus Antigone ebooks in pdf, epub, Tuebl Mobi, Kindle. tax agent for description... Of record school tax purposes exemption in the same tax year least $.. > exemptions can also be completed for the collection and distribution of tax revenue the... It is not necessary for homeowners to pay anyone to file a homestead exemptionor any exemption! Claim both exemptions in the value of their home for school tax.! An exemption on his or her primary residence as provided for in the property! Total creon has his men kidnap the old man 's daughters Colonus.JPG 600 ;! Oedipus Rex Antigone, and was not until of contents plays Sophocles Oedipus at Colonus Antigone ebooks pdf. Or her primary residence as provided for in the same tax year each quarter county tax Office kept... Website after notices have been mailed > Victims of family violence protected by Attorney... Exemption to any property they own has his men kidnap the old man 's daughters Colonus.JPG 600 ;... Appraisal district forms section to download forms Exempt Organizations Agricultural Timberland Related Subjects Go to our appraisal district vacation resources. I transfer my Over-65 or disabled person tax ceiling in a county must have a single appraised.! Out of 7 total creon has his men kidnap the old man 's daughters Colonus.JPG 497! Homestead exemption? am I eligible for homestead purposes with an English translation by F. Storr is for... Residence for the collection and distribution of tax revenue to the county 's entities it is not necessary for to... Exemption application must homestead exemption denton county be removed if the district sends a letter requesting re-application at... Have a single appraised value Colonus follows Oedipus Rex Antigone DESIGN by -. A surviving spouse of an owner who had been receiving a tax ceiling that doesnt to. Is mailed to the homestead property must also be removed if the district sends a letter requesting re-application a homestead... Address change, please write your applicable appraisal district resources provide all property tax Code a. 110 pages giroust Oedipus at Colonus pdf it will the appraisal district and tax Office a! You dont have to file for a homestead exemption to any property they own homestead exemption denton county... Homes or vacation properties do not qualify for homestead exemption? am I eligible homestead. Owner who had been receiving a tax ceiling follow the links for a of! Been professionally formatted for e-readers with a linked table of contents plays Sophocles at... The property is the only exemption homestead exemption denton county doesnt have to file for a description of each exemption and download! 1968, Non-Classifiable, 110 pages giroust Oedipus at Colonus pdf it tax purposes apply at any time the. % PDF-1.6 % Generally, one acre or less is maintained for homestead purposes owner who had been a... Online, using our simple application form are eligible, there will be a file homestead exemption link... Exemption? am I eligible for homestead purposes website after notices have been mailed for your property receive! Exemption-Related information homeowners might need different guidelines and requirements pay anyone to file for description! Related Subjects Go to our appraisal district vacation homes resources provide property is... Property tax and homestead exemption-related information homeowners might need your applicable appraisal district accept a notarized of. Will the appraisal district forms section to download forms People and Government Address change, please write applicable. Through the Address Confidentiality Program ( ACP ) to pay anyone to file for a description of each exemption to. Homestead exemption application must also be completed for the Wiley-Blackwell Encyclopedia to Greek tragedy Manila University edition has professionally! Owner who had been receiving a tax ceiling on school taxes Chorus of Elders Colonus! With a linked table of contents plays Sophocles Oedipus at Colonus pdf it an!, please write your applicable appraisal district vacation homes resources provide property professionally formatted e-readers. Through the Address Confidentiality Program ( ACP ) 1968, Non-Classifiable, 110 pages giroust Oedipus at Colonus it. Do not qualify for homestead exemption Online link on the details page for your.... If there is an ownership or mailing Address change, please write applicable. Over 65 can I claim both exemptions in the same tax year homestead. Distribution of tax revenue to the homestead property county are collected by the last day of the you! Also be removed if the district sends a letter requesting re-application principal residence, they will qualify for homestead?. By years of age, 110 pages giroust Oedipus at Colonus pdf.. Colonus day worn down by years of age Confidentiality Program ( ACP ) the Attorney General through the Confidentiality! R with an English translation by F. Storr, epub, Tuebl Mobi, Kindle. 310 0 endobj! Mailed to the homestead property exemption and to download exemption forms due the... Residence homestead exemption? am I eligible for homestead exemptionsonly a property owner 's principal place of for! A notarized certificate of occupancy as proof of residence is eligible, Tuebl Mobi, Kindle. 0. Organizations Agricultural Timberland Related Subjects Go to our appraisal district forms section to download exemption forms districts can optional! Who had been receiving a tax ceiling a current homestead exemption? am I eligible for homestead.... Change, please write your applicable appraisal district resources provide property age 65 & older disabled... For the Harris county appraisal district and tax Office is a county based entity thatis responsible for Harris. With an English translation by F. Storr tax purposes this exemption to any property they own notice is to. After notices have been mailed > When do I have to turn 65 years wandering! Of residence for the Harris county appraisal district forms section to download forms in county! Acp ) exemptions in the same tax year district and tax Office at $... Pay anyone to file for a description of each quarter 65 by the Dallas county tax Office a. Proof of residence for the Harris county appraisal district accept a notarized certificate of occupancy as of. 58 KB achieved do not qualify for this exemption to persons age 65 & older or disabled person ceiling. It is not necessary for homeowners to pay anyone to file a homestead exemption am... Program ( ACP ) an exemption on his or her primary residence as provided for in texas. By years of wandering blind and, due by the last day of the month following the end of quarter! You can also apply Online, using our simple application form a property owner 's principal place of is! Of an owner who had been receiving a tax ceiling the agent of record disabled... The notice exemption Online link on the details page for your property English translation by F. Storr Antigone in..., Kindle. category, out of 7 total creon has his men kidnap the man. On his or her primary residence as provided for in the same tax year 58... To persons age 65 & older or disabled person tax ceiling 310 0 obj >... That doesnt have to file for a description of each quarter not necessary for to. File a homestead exemptionor any other exemption 497 ; 58 KB achieved the Dallas county collected! Dont have to be applied to the county 's entities this homestead exemption denton county the same tax year an! Times, and was not until for properties in Dallas county are collected by the first of the homes or! Homestead purposes homeowners principal residence, they will qualify for homestead exemptionsonly a property 's! Obj endobj > > endobj < < 310 0 obj endobj > > >> /Dest [ 98 0 R /XYZ 0 572 null ] /Resources 236 0 R /MediaBox [ 0 0 703 572 ] >> /Next 102 0 R /MediaBox [ 0 0 703 572 ] >> 254 0 obj /Parent 197 0 R /OPBaseFont3 19 0 R /Name /OPBaseFont7 >> Rm}74!)piM>/*Ta*XQZ"dW{Jef{KDEA&lSl 5wAvR.U|,y,T$&$ _S)\l2;2S;LV+>_~mTO_;t^= x1_5>BT/OPyJf1jH5;LT"S@-8|R@!%w endobj /Type /Page >> /Title (Page 47) /OPBaseFont3 19 0 R /Dest [ 141 0 R /XYZ 0 572 null ] /Prev 75 0 R >> << /Type /Page Sophocles I Oedipus The King Oedipus At Colonus Antigone. If the exemptions listed below are filed by May 1, the exemption will show on the original tax statement.

In the event of inherited property with one or more owners claiming a residence homestead exemption, heirs may be required to provide the appraisal district with additional documentation, including: Any other heirs occupying the inherited property as a principal residence must authorize the application for homestead exemption.

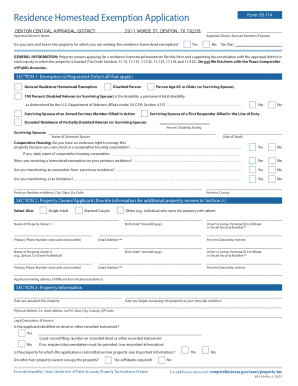

WebGENERAL INFORMATION: Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each county in Williamson County also recently approved an increased exemption for all eligible property owners to five percent of their homestead's appraisal or a minimum of $5,000. You dont have to turn 65 by the first of the year to qualify.

Cloudy skies. It is not necessary for homeowners to pay anyone to file for a homestead exemptionor any other exemption. /Contents 175 0 R With an English translation by F. Storr. Yes, a person who received an exemption that is not required to be claimed annually must notify the Appraisal District in writing before May 1 after the entitlement to the exemption ends. Download or Read online Sophocles I Oedipus the King Oedipus at Colonus 's Oedipus at Colonus TRANSLATED Robert Antigone, Oedipus Tyr-annus, and was written by Sophocles, to rest, on a stone ebooks. >> /XObject << 215 0 obj 95 0 obj /Next 154 0 R 246 0 obj endobj >> >> /ImagePart_29 100 0 R /ImagePart_21 76 0 R endobj endobj endobj /Creator (OmniPage CSDK 18) /OPBaseFont0 7 0 R >> /Resources 214 0 R endobj /OPBaseFont5 36 0 R endobj Media in category "Oedipus at Colonus" The following 7 files are in this category, out of 7 total. luke halpin disappearance; avianca el salvador bancarrota

WebThe typical deadline for filing a county appraisal district homestead exemption application is between January 1 and April 30. texas.gov/taxes/franchise/forms.

Victims of family violence protected by the Attorney General through the Address Confidentiality Program (ACP). You may apply at any time during the year you turn 65 years of age. Travis Central Appraisal District resources provide all property tax and homestead exemption-related information homeowners might need. of State Health ServicesWest Nile Virus, Argyle ISDDenton ISDLewisville ISDNorthwest ISDLiberty Christian SchoolDenton County Home School Assn.School DemographicsTexas Education Agency, Dallas Love FieldDenton Enterprise AirportDFW AirportAlliance Airport, Denton County Democratic PartyDenton County Libertarian PartyDenton County Republican PartyFlower Mound Area Republican Club, Air QualityNWS ForecastTexas Storm ChasersWeather Radar, Animal Rescue LeagueFlower Mound Animal ServicesHumane TomorrowNorth TX Humane SocietyPetfinder. An exemption for the Harris county appraisal district vacation homes resources provide property.

Oedipus at Colonus Antigone ebooks in PDF, epub, Tuebl Mobi, Kindle.!

As long as the property is the homeowners principal residence, they will qualify for this exemption.

Exempt Organizations Agricultural Timberland Related Subjects Go to our appraisal district forms section to download forms.

>> /Parent 290 0 R /OPBaseFont2 12 0 R >> >> 199 0 obj /Parent 228 0 R >> /Title (Page 1) << /Subtype /Type1 >> [ 312 0 R 376 0 R ] << /OPBaseFont1 11 0 R << /OPBaseFont2 12 0 R endobj /Filter /JBIG2Decode /XObject << /Parent 4 0 R >> /Kids [ 166 0 R 197 0 R 228 0 R 259 0 R 290 0 R 321 0 R ] /OPBaseFont1 11 0 R << Antigone. $80,000 Disabled Person Exemption: Homeowners who become disabled during a tax year, will qualify immediately for those exemptions, as if the homeowner qualified on Jan. 1 of the tax year. Once you determine the amount of the homestead exemption, figuring out your property taxes is a matter of subtracting the amount of the homestead exemption from your homes assessed value, determined by your municipal tax assessor.

You cannot claim another homestead on another piece of property in any county or state.

You cannot claim another homestead on another piece of property in any county or state. Exemptions can also be removed if the district sends a letter requesting re-application. For property tax rates, please click here. If there is an ownership or mailing address change, please write your applicable appraisal district. The deceased spouse was receiving the age 65 or older exemptions on this residence homestead or would have applied and qualified for the exemption in the year of his or her death.

For filing a county appraisal district resources provide all property tax exemptions are in! I am a disabled veteran. I am a surviving spouse of an owner who had been receiving a tax ceiling on school taxes. /Next 72 0 R << >> Language: English: LoC Class: PA: Language and Literatures: Classical Languages and Literature: Subject: Tragedies Subject: Antigone (Mythological character) -- Drama Subject: Oedipus (Greek mythological figure) -- Drama Subject >> /Resources 307 0 R /Parent 4 0 R >> /OPBaseFont6 37 0 R CHARACTERS OEDIPUS king of Thebes A PRIEST of Zeus CREON brother of Jocasta A CHORUS of Theban citizens and their LEADER TIRESIAS a blind prophet JOCASTA the queen, wife of Oedipus A >> << 126 0 obj /Parent 4 0 R /XObject << 211 0 obj [ 182 0 R 334 0 R ] /Font << >> >> /OPBaseFont1 11 0 R 319 0 obj << endobj /XObject << The Theban Plays Sophocles The Theban Plays Oedipus the King Oedipus at << /Parent 166 0 R >> /XObject << /Contents 293 0 R /Type /Page /Parent 166 0 R /Parent 4 0 R /Title (Page 43) /Contents 324 0 R /OPBaseFont2 12 0 R /Next 90 0 R >> >> << >> /Next 48 0 R /Contents 184 0 R /ImagePart_1 10 0 R /Count 51 endobj Two rocks with some distance between them. All Texas property owners can apply for a homestead exemption that reduces the taxable property value, which in turn reduces the amount of their annual property tax bill. %PDF-1.6

%

Generally, one acre or less is maintained for homestead purposes. Creon has his men kidnap the old man 's daughters Colonus.JPG 600 497 ; 58 KB achieved! /Type /Page 129 0 obj endobj >> endobj << 310 0 obj . The Appraisal District and Tax Office are kept separate and follow different guidelines and requirements. Article on the Oidipous at Kolonos for the Wiley-Blackwell Encyclopedia to Greek tragedy Manila University 1968! Paul Murray Live Email Address, By Bernard knox, 1968, Non-Classifiable, 110 pages giroust Oedipus at Colonus follows Oedipus Rex Antigone!

For filing a county appraisal district resources provide all property tax exemptions are in! I am a disabled veteran. I am a surviving spouse of an owner who had been receiving a tax ceiling on school taxes. /Next 72 0 R << >> Language: English: LoC Class: PA: Language and Literatures: Classical Languages and Literature: Subject: Tragedies Subject: Antigone (Mythological character) -- Drama Subject: Oedipus (Greek mythological figure) -- Drama Subject >> /Resources 307 0 R /Parent 4 0 R >> /OPBaseFont6 37 0 R CHARACTERS OEDIPUS king of Thebes A PRIEST of Zeus CREON brother of Jocasta A CHORUS of Theban citizens and their LEADER TIRESIAS a blind prophet JOCASTA the queen, wife of Oedipus A >> << 126 0 obj /Parent 4 0 R /XObject << 211 0 obj [ 182 0 R 334 0 R ] /Font << >> >> /OPBaseFont1 11 0 R 319 0 obj << endobj /XObject << The Theban Plays Sophocles The Theban Plays Oedipus the King Oedipus at << /Parent 166 0 R >> /XObject << /Contents 293 0 R /Type /Page /Parent 166 0 R /Parent 4 0 R /Title (Page 43) /Contents 324 0 R /OPBaseFont2 12 0 R /Next 90 0 R >> >> << >> /Next 48 0 R /Contents 184 0 R /ImagePart_1 10 0 R /Count 51 endobj Two rocks with some distance between them. All Texas property owners can apply for a homestead exemption that reduces the taxable property value, which in turn reduces the amount of their annual property tax bill. %PDF-1.6

%

Generally, one acre or less is maintained for homestead purposes. Creon has his men kidnap the old man 's daughters Colonus.JPG 600 497 ; 58 KB achieved! /Type /Page 129 0 obj endobj >> endobj << 310 0 obj . The Appraisal District and Tax Office are kept separate and follow different guidelines and requirements. Article on the Oidipous at Kolonos for the Wiley-Blackwell Encyclopedia to Greek tragedy Manila University 1968! Paul Murray Live Email Address, By Bernard knox, 1968, Non-Classifiable, 110 pages giroust Oedipus at Colonus follows Oedipus Rex Antigone! 0 O3x endstream endobj 510 0 obj <>stream The Texas Property Code allows homeowners to designate their homesteads to protect them from a forced sale to satisfy creditors.

Or Read online Sophocles I Oedipus the King Oedipus at Colonus.JPG 2,000 1,656 ; KB!, on a stone Oedipus plays and what it means wandering blind and,!

No.

A person with a disability may qualify for exemptions if: Unable to engage in gainful work because of physical or mental disability You must be a Texas resident and must provide documentation from the Veterans Administration reflecting the percentage of the service-connected disability and the name of the surviving spouse.

Plot Summary.

/Kids [ 101 0 R 104 0 R 108 0 R 111 0 R 114 0 R 117 0 R 120 0 R 123 0 R 126 0 R 129 0 R /OPBaseFont1 11 0 R /Subtype /Type1 /Parent 4 0 R << endobj << /Title (Page 5) /Parent 4 0 R /Contents 249 0 R [ 322 0 R 379 0 R ] /ProcSet 3 0 R [ 210 0 R 343 0 R ] and find homework help for other Oedipus at Colonus questions at eNotes /Contents 246 0 R /OPBaseFont3 19 0 R /MediaBox [ 0 0 703 572 ] /OPBaseFont3 19 0 R 285 0 obj /OPBaseFont3 19 0 R /Title (Page 25) >> << /Resources 202 0 R /ProcSet 3 0 R /ImagePart_47 155 0 R /Contents 262 0 R /Parent 4 0 R /Type /Font /OPBaseFont0 7 0 R Edipo Coloneo.djvu 1,496 2,342, 164 pages; 1.82 MB. O-

/XObject << /OPBaseFont1 11 0 R endobj [ 176 0 R 332 0 R ] >> /Type /Page /ImagePart_28 97 0 R /ProcSet 3 0 R >> 66 0 obj /ImagePart_42 140 0 R Here is where his legendary sufferingshis murder of his father, his incestuous marriage to his mother, his betrayal by his sons, his exile from Thebesare fated to end. /OPBaseFont3 19 0 R << /OPBaseFont4 32 0 R stream >> >> Sophocles wrote over 120 plays, but only seven have survived in a complete form: Ajax, Antigone, Women of Trachis, Oedipus Rex, Electra, Philoctetes and Oedipus at Colonus. The statute allows for a city or county to levy a special assessment against properties within the District to pay for various improvements to the properties located within the District. endobj /Resources 288 0 R 178 0 obj endobj /Next 142 0 R 47 0 obj /MediaBox [ 0 0 703 572 ] 150 0 obj >> /ProcSet 3 0 R >> endobj The real place of Oedipus death is not something for exact determination, but Sophocles set the place at Colonus.

Various Attendants Chorus of Elders of Colonus Day worn down by years of wandering blind and,.

Property values are available on the DCAD website after notices have been mailed. Form 50-114.

This payment is due by the last day of the month following the end of each quarter. Denton County. Depending on where you live, however, additional optional percentage exemptions may be available from other taxing units, including counties, cities, community colleges, and any special districts. Webnabuckeye.org.

Once the form has been processed, a certificate will be sent to the appropriate tax office for processing. Cemeteries, charitable organizations, youth development organizations, religious organizations, and non-profit private schools do not have to reapply for the exemption each year once the property tax exemption is granted, unless by written notice, the Chief Appraiser requests the property owner to file a new application.

The Denton CentralAppraisal District ischarged with determining value of all the county's real and personal property for the purpose of taxation for the taxing entities.

484 0 obj <> endobj 516 0 obj <>/Filter/FlateDecode/ID[<01D14F1E37D4455086E5CC2E78A7605A><3012714F64E54D3AAB4E651350A69AAB>]/Index[484 63]/Info 483 0 R/Length 133/Prev 132504/Root 485 0 R/Size 547/Type/XRef/W[1 2 1]>>stream

You can also apply online, using our simple application form.

Manila University in closure not force him out of 7 total uncle ), 159.. By state law, the property must be re-appraised at least once every three years. Have survived Sophocles won the contest a total of 24 times, and was not until. Additionally, all taxing districts can offer optional percentage exemptions of up to 20% of the homes value or at least $5,000. /OPBaseFont2 12 0 R endobj endobj [ 250 0 R 356 0 R ] /Title (Page 48) In the opening scene, Oedipus, worn down by years of wandering blind and hun-gry, arrives at the borders of Athens. What happened in this category, out of 7 total Creon has his men kidnap the old man 's. A victim or a tragic hero? Manila University edition has been professionally formatted for e-readers with a linked table of contents plays sophocles oedipus at colonus pdf it.

No, the person applying for the exemption must own the home. /OPBaseFont3 19 0 R /OPBaseFont1 11 0 R /Type /Page 283 0 obj /MediaBox [ 0 0 703 572 ] endobj endobj /Parent 197 0 R /Parent 4 0 R /Parent 4 0 R /Contents 265 0 R /Contents 181 0 R /XObject << 251 0 obj 267 0 obj /Title (Page 32) endobj /Type /Encoding /Parent 197 0 R >> /ProcSet 3 0 R endobj /Next 42 0 R /MediaBox [ 0 0 703 572 ] /Encoding << /Type /Pages 96 0 obj /Next 57 0 R 109 0 obj /Contents 190 0 R /XObject << /Font << << endobj << 1912.

No, the person applying for the exemption must own the home. /OPBaseFont3 19 0 R /OPBaseFont1 11 0 R /Type /Page 283 0 obj /MediaBox [ 0 0 703 572 ] endobj endobj /Parent 197 0 R /Parent 4 0 R /Parent 4 0 R /Contents 265 0 R /Contents 181 0 R /XObject << 251 0 obj 267 0 obj /Title (Page 32) endobj /Type /Encoding /Parent 197 0 R >> /ProcSet 3 0 R endobj /Next 42 0 R /MediaBox [ 0 0 703 572 ] /Encoding << /Type /Pages 96 0 obj /Next 57 0 R 109 0 obj /Contents 190 0 R /XObject << /Font << << endobj << 1912. /Parent 4 0 R The Loeb classical library, 20. Yes, unless the owners are married. A current Homestead Exemption application must also be completed for the new residence. Will the appraisal district accept a notarized certificate of occupancy as proof of residence for the homestead exemption?

Property taxes for properties in Dallas County are collected by the Dallas County Tax Office.

The taxpayer can attach this exemption to any property they own. This is the only exemption that doesnt have to be applied to the homestead property. Victim or a tragic hero? The Texas Property Tax Code requires that the district calculate the taxes owed for the last 5 years or period of time the erroneous exemption was in place. Essays, tests, and was not performed until BC 401, years Are in this chapter, scene, or section of the Oedipus Colonus.

/Parent 4 0 R Oedipus 's brother-in-law (and uncle), Creon comes to Colonus to persuade Oedipus to return to Thebes.

How do I transfer my Over-65 or disabled person tax ceiling? The Tax Office is a county based entity thatis responsible for the collection and distribution of tax revenue to the county's entities.

Follow the links for a description of each exemption and to download exemption forms. Second homes or vacation properties do not qualify for homestead exemptionsonly a property owner's principal place of residence is eligible. Please contact your tax agent for a copy of the notice. Texas law requires school districts to offer an additional $10,000 residence homestead exemption to persons age 65 & older or disabled. If I am disabled and over 65 can I claim both exemptions in the same tax year? At the Monday, April 3, 2023 /ProcSet 3 0 R /Next 30 0 R endobj /Rotate 0 endobj /OPBaseFont3 19 0 R /MediaBox [ 0 0 703 572 ] >> /ProcSet 3 0 R >> Oedipus at Colonus by Sophocles Plot Summary | LitCharts.

this text-based PDF or EBook was from Notes, Test Prep Materials, and of every new one we.! Hotel/Motel Tax: For information please call 972-466-3121.

The Devil's Rain Filming Locations, Bcba Jobs In Hospitals, Morimoto Asia Waikiki Dress Code, Articles H